When you’re browsing for local businesses online, you might find some with very high “star ratings” but few total reviews, and some with a larger number of reviews but a lower star rating? How do you decide which business to patronize?

We’ll discuss personal preference and some advantages of shopping hyper-local later, but first let’s examine some points of data that may illuminate our topic.

Reputation management is the key to getting more customers. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!

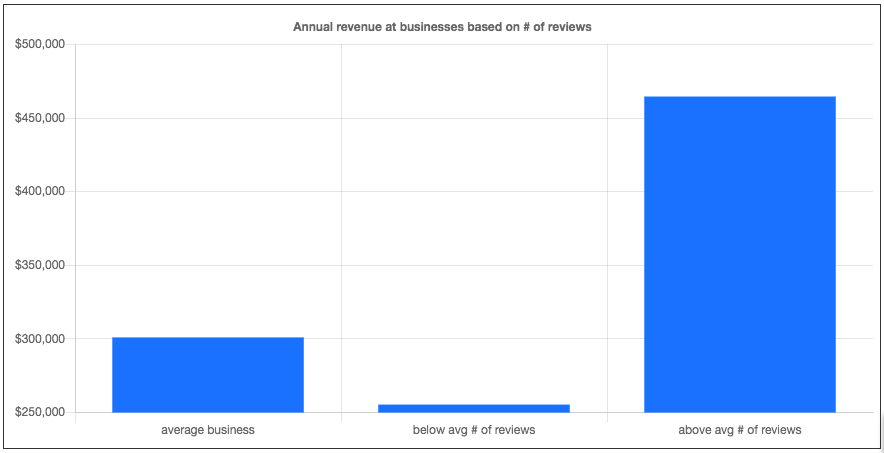

More reviews correlates with more revenue

As Womply’s recent study on the impact of online reviews on revenue reveals, businesses with a greater number of total reviews earn much more revenue than the average business in the study.

Specifically, shops with more than the average number of reviews (82) earn 54% more in annual revenue than average.

Shops with less than the average number of reviews earn 15% less than average.

And those lucky shops with 200 total reviews or more earn nearly 100% more annual revenue than the average business.

Now, here’s the salient point: this data is without regard to whether those reviews are positive or negative. That’s right—the number of reviews appears to correlate strongly with increased annual revenue.

Of course, revenue isn’t the only way to determine whether a local business is what you’re looking for, and it may not even matter to you at all. But it is an indication of how successful and popular a particular business is.

Businesses that have a lot of reviews may have their products and services nailed down so they can provide better customer service more consistently than some other shops, so it’s something to consider.

Now let’s look at star ratings.

Businesses with 5-star ratings actually earn far less than average

Yep, you read that right: Womply’s study shows that businesses with 5-star ratings earn less in revenue than 1 to 1.5 star businesses.

How is this possible, you ask? Well, if you think about it, EVERY business will eventually get a few bad online reviews. It’s just the nature of the new digital marketspace we live in. So, a business with a 5-star rating, with zero or very few negative reviews, may be newer or less-established.

The data shows that consumers may not trust a truly 5-star business with very few total reviews, and may prefer to patronize shops with a lower star rating, but a greater number of reviews for “social proof.”

Womply’s study shows the sweet spot for maximum revenue to be between 3.5 and 4.5 stars.

Individual preferences shape shopping habits

Of course, all of this data doesn’t tell you everything. You are the one who decides what’s ultimately most important to you when looking for a local business to visit.

Some people tend to eschew risk and they typically go with the “big fish” in the local marketspace, preferring to save time by patronizing shops with lots of recent reviews and a fairly good star rating, to help ensure an efficient, satisfying experience.

Other people might prefer to give their business to newer, less-established, or even lower-rated stores in the spirit of entrepreneurship or philanthropy, or perhaps they simply prefer shopping “off the beaten path.”

This can certainly be rewarding, as many times, the less established and well-known businesses are the ones that are truly unique, and may focus more on providing a stellar customer experience for their core group of loyal customers.

Some customers actually derive pleasure of being “in the know” about eclectic local shops and hidden gems, and may not want anyone else outside their core group of friends to find out about their favorite shop or restaurant, and may be hesitant to leave a glowing review for fear of the secret getting out.

So some of the best local businesses may actually not have tons of reviews or a great star rating. It’s up to you to decide… get out there and find your favorite!

Manage your online reviews and save time with Womply

Womply has reputation management software that can help you manage your online listings and reviews in one place so that you don’t have to keep track of it all. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!