In this report:

- How has COVID-19 hurt—or helped—different types of local retailers?

- What did “panic week” look like for local retail in 2019?

- Top 5 types of retailers that rely on a big panic week

- How many of these retail shops have had to close as a result of COVID-19?

The holiday shopping season is huge for local retailers across the country, and “panic week,” or the week before Christmas, is often the top week of the year overall for many types of businesses. However, with the COVID-19 pandemic hitting main street particularly hard, many local retail businesses are hoping that this year’s last-minute shopping season will be a major breakthrough.

Womply Research has been examining revenue and transaction data for local retailers across the U.S., and has uncovered some interesting trends that may be good—or bad—news for small retailers, depending on what subcategory of “retail” they specialize in.

With Womply Email Marketing, you can turn customers into regulars and get more repeat business with targeted emails that send automatically when customers transact with you. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!

How has COVID-19 hurt—or helped—different types of local retailers?

It’s important to note that not all retail businesses have been hit by COVID-19 to the same degree, or even in the same way. Some types of retail businesses have actually seen sales increase since the start of the pandemic. Sporting goods, electronics, appliance shops, and bike stores, for example, have had significant increases in revenue. We’ve also seen huge spikes in grocery stores periodically.

Some types of retail don’t appear to have been impacted positively or negatively and have remained steady year-over-year. Tobacco and smoke shops, pools and pool supply businesses, furniture stores, and hobby/hardware stores are some that have been fairly stable.

However, most local retailers have been hit hard by COVID-19, with some types of retail revenue down over 70% compared to 2019. Women’s stores, music/video/DVD shops, department and discount stores, men’s stores, cosmetic shops, and bookstores are among those that have taken the most damage financially.

Of course, each of these retail shops would welcome a strong last-minute shopping season this year, but we next wanted to see which retailers typically rely the most on strong “panic week” sales.

So our data science team analyzed credit card transaction data at local retail businesses in 2019 to see which ones had especially huge last-minute shopping surges. (For this analysis we defined “panic week” 2019 as Monday, December 16 through Sunday, December 22.)

What did panic week look like for local retail in 2019?

In 2019, panic week was the #1 week of the year for retail businesses as a whole. Consumer spending was up 32% compared to the average week throughout the year, and average transactions per location were up 25% compared to average.

While these numbers show that retailers were exceptionally busy during panic week last year, the average ticket size (how much each customer spent per transaction) was also up 7%. So, lots more people spending lots more money made for a huge week in local retail for 2019.

Here are the types of retail businesses where panic week was especially huge:

Let’s dive deeper into the 5 categories where panic week was the biggest in 2019.

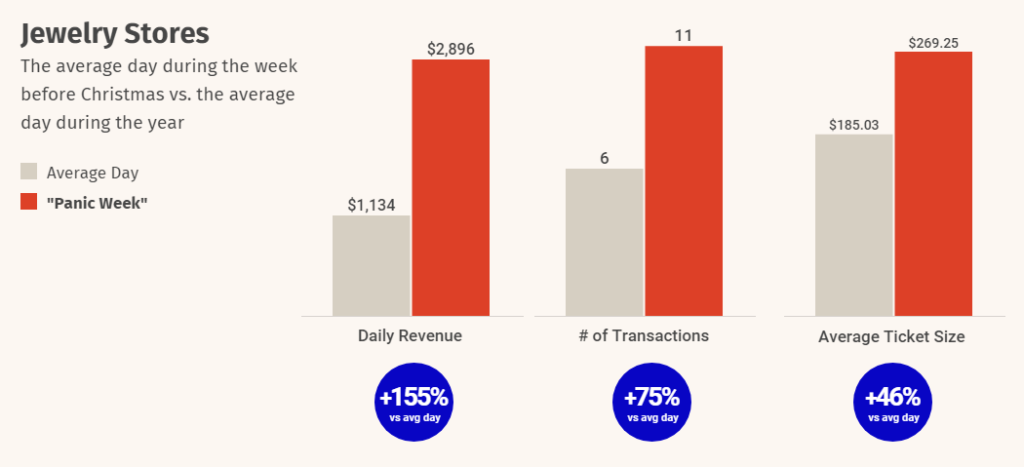

#1: Jewelry stores

Last-minute holiday shopping is absolutely enormous for jewelry stores in a typical year. During panic week 2019, jewelry stores brought in an average of $2,896 in revenue, compared to their 2019 weekly average of $1,134.

The average jewelry store was much busier than usual during panic week, as daily transactions nearly doubled from their typical 6 to 11 during panic week. Shoppers were also a lot more likely to spend a little extra to make their last-minute gift a special one, as the average ticket price rose to $269.25 from their average $185.03 per transaction.

As we detailed in the chart above, consumer spending at jewelry stores skyrocketed during the last week before Christmas, jumping a whopping 197% more than a typical week. But while consumer spending shows us the total number of dollars being spent in a given category, let’s take a closer look at what things looked like for the average individual jewelry store by comparing a day during panic week to a typical day throughout the year.

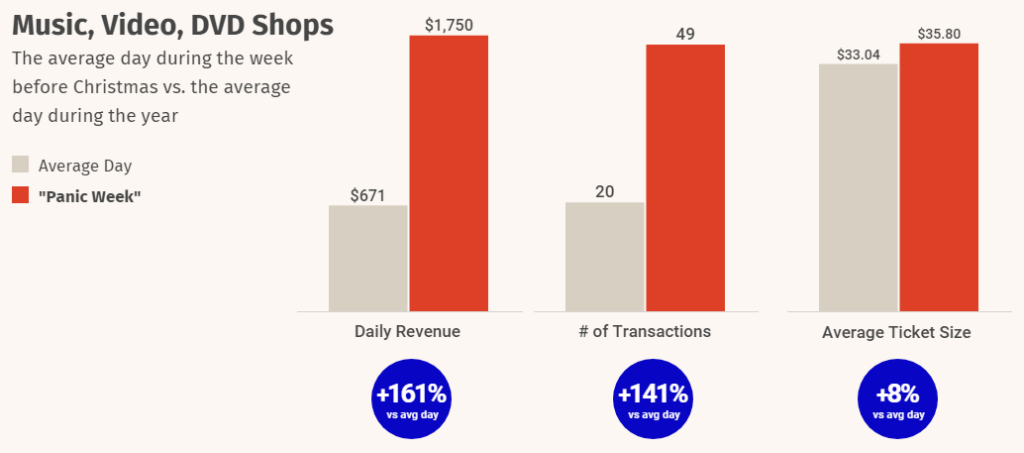

#2: Music, Video, and DVD Shops

Jewelry stores may have seen the biggest increase in total consumer spending, but as far as the average individual retail shop goes, music, video, and DVD shops saw the biggest increase in daily revenue.

On a typical day during the year, music, video, and DVD shops bring in about $671 in revenue, but during panic week, that number skyrocketed to $1,750. This was driven almost entirely by a huge surge in foot traffic, with average transactions jumping from 20 to 49.

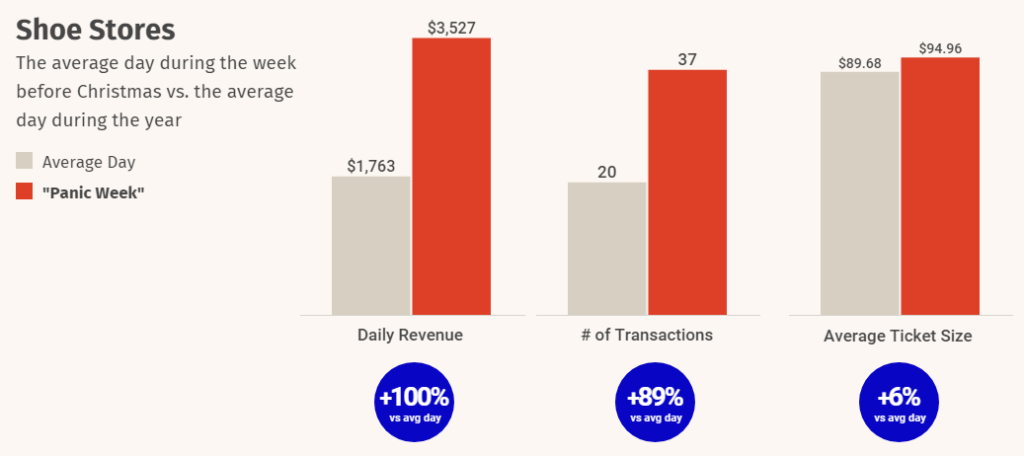

#3: Shoe Stores

Average daily revenue at local shoe stores during panic week was double that of a typical day throughout the year. Up to $3,527 compared to a normal day’s $1,763.

As is the case with most types of stores during panic week, this is driven mostly by increased foot traffic (pun intended). The average shoe store processed nearly twice as many transactions during panic week, with the average ticket up a few dollars compared to normal.

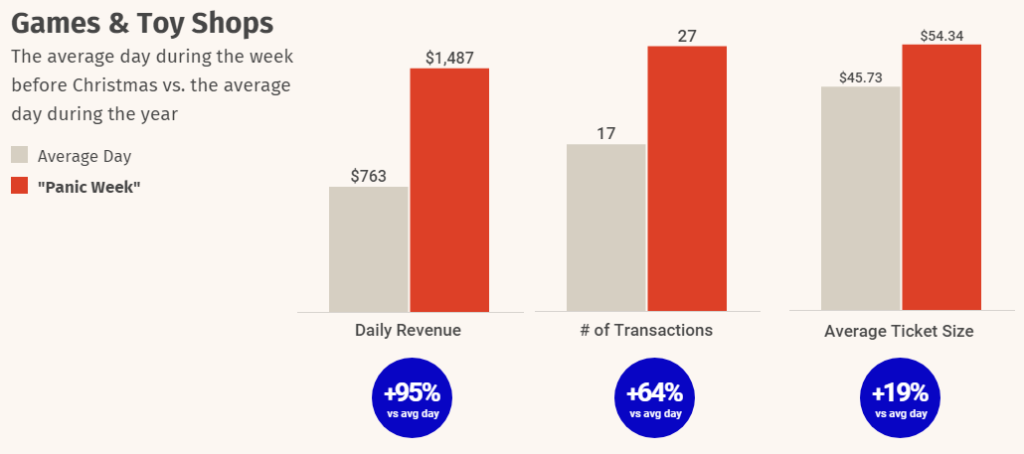

#4: Games and Toy Shops

Perhaps the least surprising bit of information in this article is that game and toy shops do nearly twice as much revenue each day during the last week before Christmas than the average day.

With a 64% increase in average transactions and a healthy 19% increase in average ticket size, there’s no doubt that a solid holiday shopping season is crucial for local games and toy shops across the country.

#5: Gift and Novelty Shops

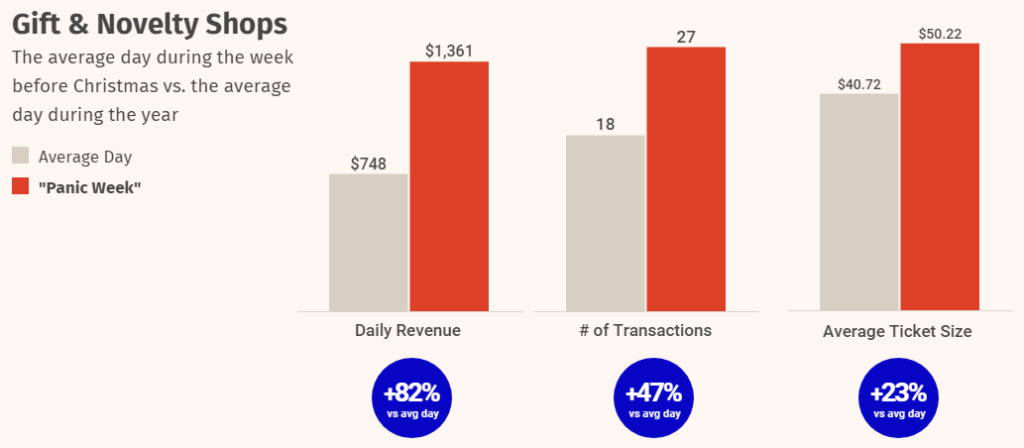

As you might expect, gift and novelty shops look remarkably similar to game and toy shops. There’s certainly a lot of overlap between the two types of shops, with gift and novelty shops seeing healthy increases in revenue, transactions, and ticket sizes alike during panic week.

How has COVID-19 impacted consumer spending at the types of retail shops who rely most on a strong holiday shopping season?

As we covered at the beginning of this article, the pandemic has hit some types of retail shops much harder than others. With cases rising across the country, and major question marks about how this might impact local retailers, we wanted to take a closer look at how COVID has impacted these five types of retail shops.

We’ll start by examining how weekly consumer spending in each retail category in 2020 has compared to the same week in 2019.

Early in the pandemic, shoe stores were hit the hardest, with sales dropping to nearly zero. Things rebounded for shoe stores, however, with sales actually increasing year-over-year in the summertime.

Game and toys shops experienced the shallowest drop early on, but after a relatively strong summer, they are slumping and it’s clear they will be hoping for a strong panic week.

Jewelry stores have experienced a surprisingly strong recovery, with consumer spending staying close to, or slightly above, 2019’s levels since mid-June.

The same can’t be said, sadly, for music, video, and DVD shops. A type of local retail shop that was already struggling to compete with online giants was hit hard by the pandemic and hasn’t yet come close to recovery, with revenue still hovering at about 60% less than a year ago.

A really strong panic week for these shops would be a welcome relief.

How many of these retail shops have had to close as a result of COVID-19?

To even better understand how COVID has impacted these types of retail shops (the local retailers who typically have the strongest “panic weeks”), we next examined how many of them had to close their doors due to the pandemic.

To determine this, we identified retail shops that were regularly transacting prior to March, and if any of those businesses stopped transacting for 3+ days, we marked them as “closed.” If that business began to transact again, we then marked them as “open” again.

Here’s a look at how many of each of these types of retail businesses were closed for each week since mid-March:

Nearly every shoe store in our analysis closed their doors from March through early May. Interestingly, despite this early spike, shoe stores currently see the lowest closure rate out of any of these types of retail shops, with only 13% of shoe stores remaining closed as of the end of November, 2020.

Gift and novelty stores, jewelry stores, and music, video, and DVD shops all experienced very similar closure rates, peaking at around 60% during the spring, before settling into the 20% range—where they’ve remained throughout the rest of this year so far.

The majority of game and toy shops were able to remain open during the height of the pandemic, but as of the last week of November, 21% of them were still closed.

What to expect for retail shops during panic week in 2020

Last-minute holiday shopping is huge for many types of retail shops across the country, but the 5 types we’ve examined above really need a solid boost of sales. Unfortunately, retail shop owners are going to have to work extra hard this year to make their customers feel comfortable as the pandemic remains deadly serious and some places have increased restrictions and/or lockdowns on retailers.

Womply’s data science team will be continuing to analyze transaction data throughout the end of the year so to be sure to check back for more analysis and articles in the coming weeks and months.

You may also like:

- Data dashboard: How COVID-19 is impacting local business revenue across the U.S.

- Womply Research: The financial impact of COVID-19 on local businesses

Remember: If you want to help maximize your efforts and save a lot of time, check out Womply’s marketing solutions for small businesses. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!