In this 2-minute read:

- How to determine your average monthly payroll for your PPP loan

- Important new changes for independent contractors and other 1040 Schedule C PPP borrowers

- How to determine your Loan Request Amount for your PPP loan

- What about NAICS code 72 businesses for second draw PPP loans?

- What to do if you have received EIDL or other SBA money in 2020

IMPORTANT NOTE: As of March 3, 2021, applicants who report their income with IRS Form 1040 Schedule C (i.e., most independent contractors, 1099 workers, and sole proprietors) will be able to use their GROSS (instead of net) profits to determine their max loan amount. This can make a big impact on the amount you can borrow, depending on how much you make and how you have reported your profits. Read more about the latest 1040 Schedule C/PPP loan rules changes, and see the new rules, and the new PPP application form for Schedule C applicants.

Background for 2021: Congress approved an extension of the PPP loan program, including “second draw” PPP loans for businesses that received PPP funding in 2020.

Pretty much every business under 500 employees in America is scrambling to apply through eligible lenders for a Paycheck Protection Program first or second draw loan under the $2 trillion CARES act and subsequent renewals of funding.

Understandably, the application process is a little confusing and a lot of business owners are asking “How do I determine my Average Monthly Payroll and/or my Loan Request Amount” when submitting a first or second draw PPP loan application? Let’s see if we can shed some light on this important issue. There are some changes for 2021 that can have a big impact on certain types of businesses, particularly those that fit into NAICS code 72.

Womply has made email marketing truly automatic for busy small business owners and all types of independent contractors. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!

How do I calculate my Average Monthly Payroll for my Paycheck Protection Program loan application?

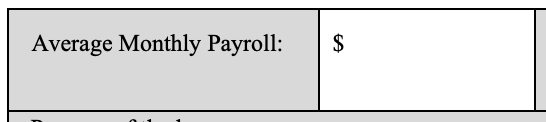

Calculating your average monthly payroll for your PPP loan is the fundamental part of the whole process, as this figure is used to determine how much you can borrow.

- This is a critical piece of information that requires that you provide payroll documentation, and is used in the calculation that determines your loan request amount. (see below)

- IMPORTANT: Don’t put $0 for your payroll (even if you have not paid anyone or yourself recently) or you’ll have to re-apply!

- Read this now to understand what qualifies as payroll costs.

- You cannot estimate this figure—you must calculate it accurately.

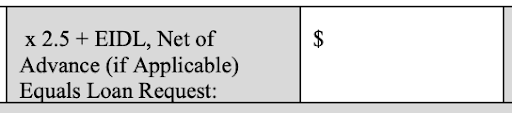

How do I calculate my Loan Request Amount correctly for a paycheck protection program loan?

- If your business HAS NOT received loans or advances under the EIDL program in 2020 then:

- Multiply your Average Monthly Payroll (the number you determined by following the steps above) by 2.5 and round to the nearest dollar (unless your business fits into NAICS code 72; then use 3.5X for second draw loans. See below)

- This formula will work for 99.9% of businesses, independent contractors, sole proprietors, and eligible self-employed businesses NOT in NAICS category 72 (food and accommodations businesses).

- IMPORTANT; IF YOUR BUSINESS IS CATEGORIZED UNDER NAICS CATEGORY 72, you may request 3.5X your average monthly payroll FOR SECOND DRAW PPP LOANS ONLY. Learn more here.

- If your business HAS received loans or advances under the EIDL program or other SBA funding in 2020, contact your loan provider and they’ll help you determine the accurate number, because it’s somewhat complicated. This only applies if you’ve received money in your bank account under EIDL or other SBA funding in 2020—otherwise apply the formula above.

- Do not enter $0 — this means you are asking for $0 in loans

- Do not enter more than $10m for first draw loans and $2m for second draw loans — you will be disqualified.

- If you request less than 2.5x your Average Monthly Payroll that means you want less money than you are eligible for. This is allowable but not recommended. You can only apply for PPP once, and deviating from the common formula may slow down your application.

PLEASE NOTE! If you submit your application with errors you cannot edit your entry and you will have to start again!

If you haven’t yet started your PPP loan application process, we recommend you submit your application immediately.

- Click to read our full list of required documentation for application for a PPP loan

- Click to read our complete article about requirements for PPP loan forgiveness

For Schedule C applicants: How do I calculate my maximum first draw PPP loan amount if I’m self-employed and have employees?

To determine your maximum first draw PPP loan amount if you are self-employed and have employees, use the following methodology to calculate your maximum loan amount:

- Step 1: Compute 2019 or 2020 payroll (using the same year for all items) by adding the following:

- At your election, either (1) the net profit amount from line 31 of your 2019 or 2020 IRS Form 1040, Schedule C, or (2) your 2019 or 2020 gross income minus employee payroll costs, calculated as your gross income reported on IRS Form 1040, Schedule C, line 7, minus your employee payroll costs reported on lines 14, 19, and 26 of IRS Form 1040, Schedule C (for either option, if you are using 2020 amounts and have not yet filed a 2020 return, fill it out and compute the value), up to $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred (if this amount is over $100,000, reduce it to $100,000, or if this amount is less than zero, set this amount at zero);

- 2019 or 2020 gross wages and tips paid to your employees whose principal place of residence is in the United States, computed using 2019 or 2020 IRS Form 941 Taxable Medicare wages & tips (line 5c, Column 1) from each quarter plus any pre-tax employee contributions for health insurance or other fringe benefits excluded from Taxable Medicare wages & tips; subtract any amounts paid to any individual employee in excess of $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred, and any amounts paid to any employee whose principal place of residence is outside the United States; and

- 2019 or 2020 employer contributions to employee group health, life, disability, vision and dental insurance (portion of IRS Form 1040, Schedule C line 14 attributable to those contributions); retirement contributions (IRS Form 1040, Schedule C, line 19); and state and local taxes assessed on employee compensation (primarily under state laws commonly referred to as the State Unemployment Tax Act or SUTA from state quarterly wage reporting forms).

- Step 2: Calculate the average monthly amount (divide the amount from Step 1 by 12).

- Step 3: Multiply the average monthly amount from Step 2 by 2.5.

- Step 4: Add the outstanding amount of any EIDL made between January 31, 2020 and April 3, 2020 that you seek to refinance. Do not include the amount of any advance under an EIDL COVID-19 loan (because it does not have to be repaid).

You must supply your 2019 or 2020 (whichever you used to calculate your loan amount) IRS Form 1040, Schedule C; Form 941 (or other tax forms or equivalent payroll processor records containing similar information); and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever you used to calculate your loan amount) or equivalent payroll processor records, along with evidence of any retirement and health insurance contributions, if applicable. A payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish you were in operation on February 15, 2020.

You will need to provide formal documentation on each of the items mentioned above as you apply for your PPP loan. For more details about this calculation process, visit our PPP loan FAQ.

Win new customers and build loyalty with your existing customers with Womply Email Marketing

Womply has made Email Marketing truly automatic for busy small business owners, independent contractors, and sole proprietors. Womply helps you turn customers into regulars and get more repeat business with targeted emails that send automatically when customers transact with you. Build customer loyalty and revenue, and get more repeat business with just a few clicks!

Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!