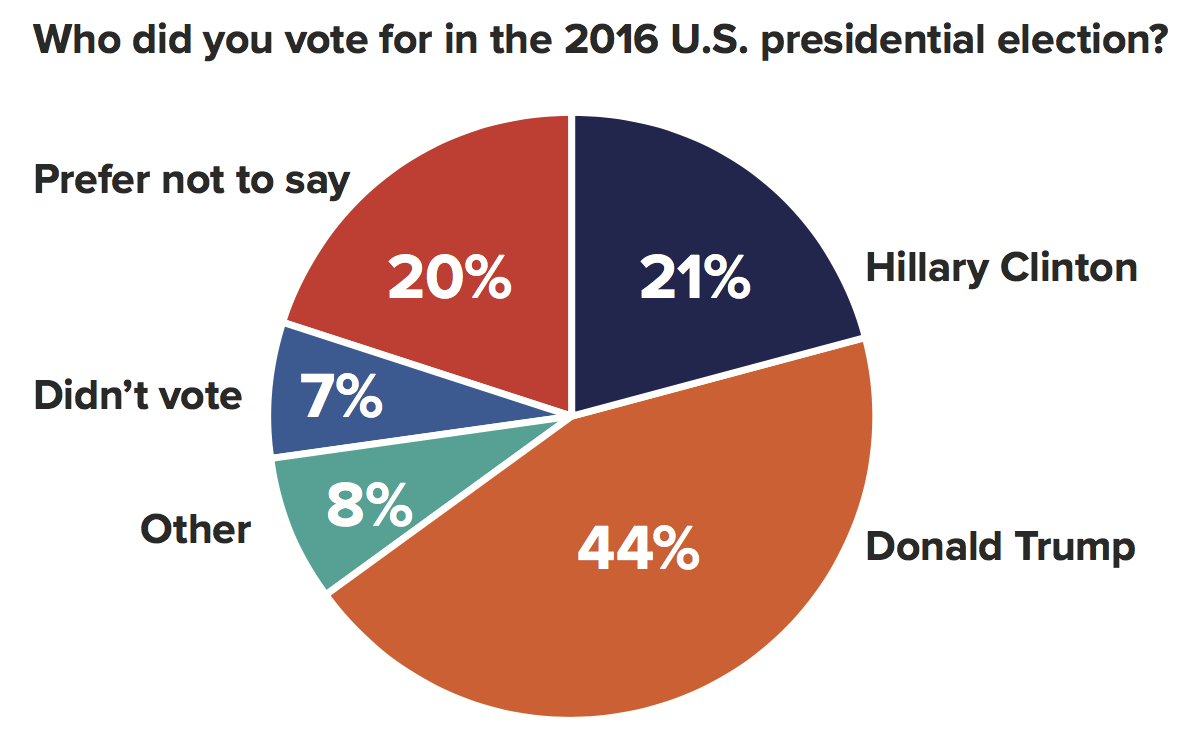

Small business owners supported Donald Trump 2-to-1 over Hillary Clinton in the 2016 presidential election, and now about half of them think President Trump is doing a good job of representing their interests in the White House, according to our national study. That’s a far cry from what small business owners think about Congress (hint: it’s not good).

Taxes. Regulations. Health care. Interest rates. Politics and policy have a major impact on American small businesses, and these businesses in turn have a major impact on the local and national economies.

To understand Main Street’s perspective on these issues and more, we surveyed nearly 5,000 small business owners in all 50 states. This report highlights the study’s key findings.

Trump Nation?

For starters, we asked business owners who they voted for in the 2016 presidential election to get a sense of how responses might be colored by partisan leanings. We filtered responses to various questions by voting preference and call out the relevant findings throughout this report.

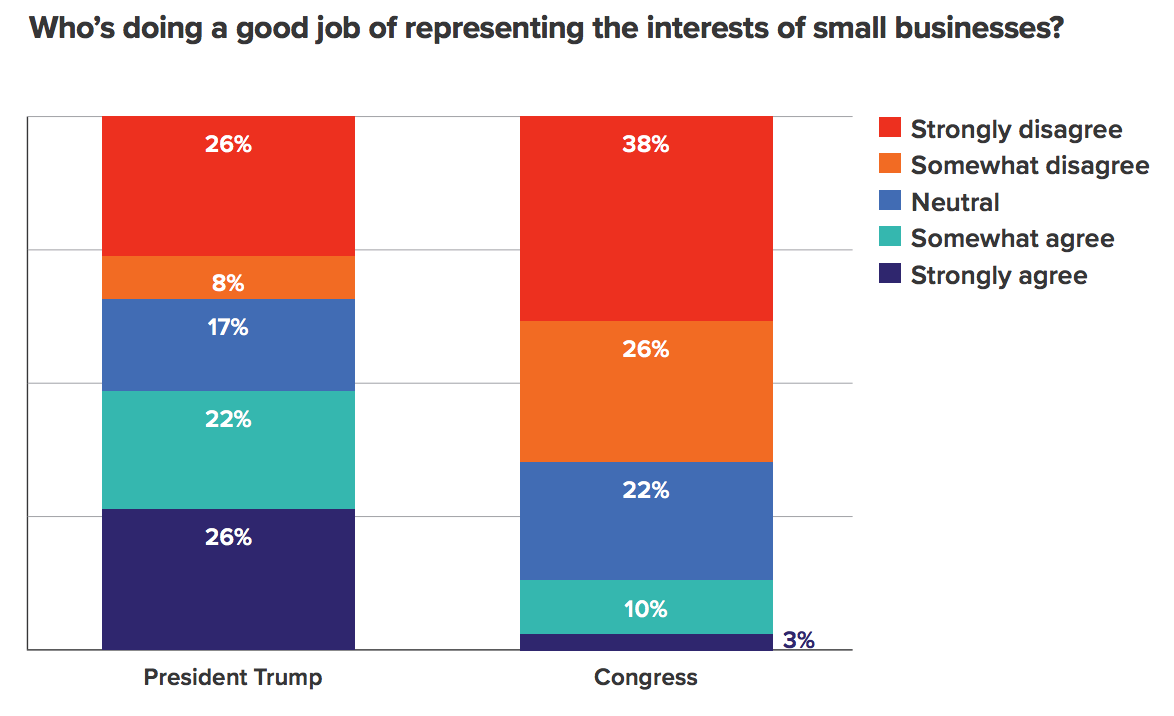

Next, we asked respondents how well they think President Trump and Congress are doing:

- Half of small business owners think President Trump is doing a good job of representing their interests.

- They’re 3.5 times more likely to say President Trump is representing their interests compared to Congress.

- Still, 1 in 4 “strongly disagree” that President Trump represents their interests

Things got more interesting when we filtered responses by Trump and Clinton supporters:

- 83% of Trump voters say Trump is doing a good job of representing small businesses’ interests compared to a paltry 7% of Clinton voters

- 20% of Trump voters approve of the job Congress is doing for small businesses compared to 5% of Clinton voters

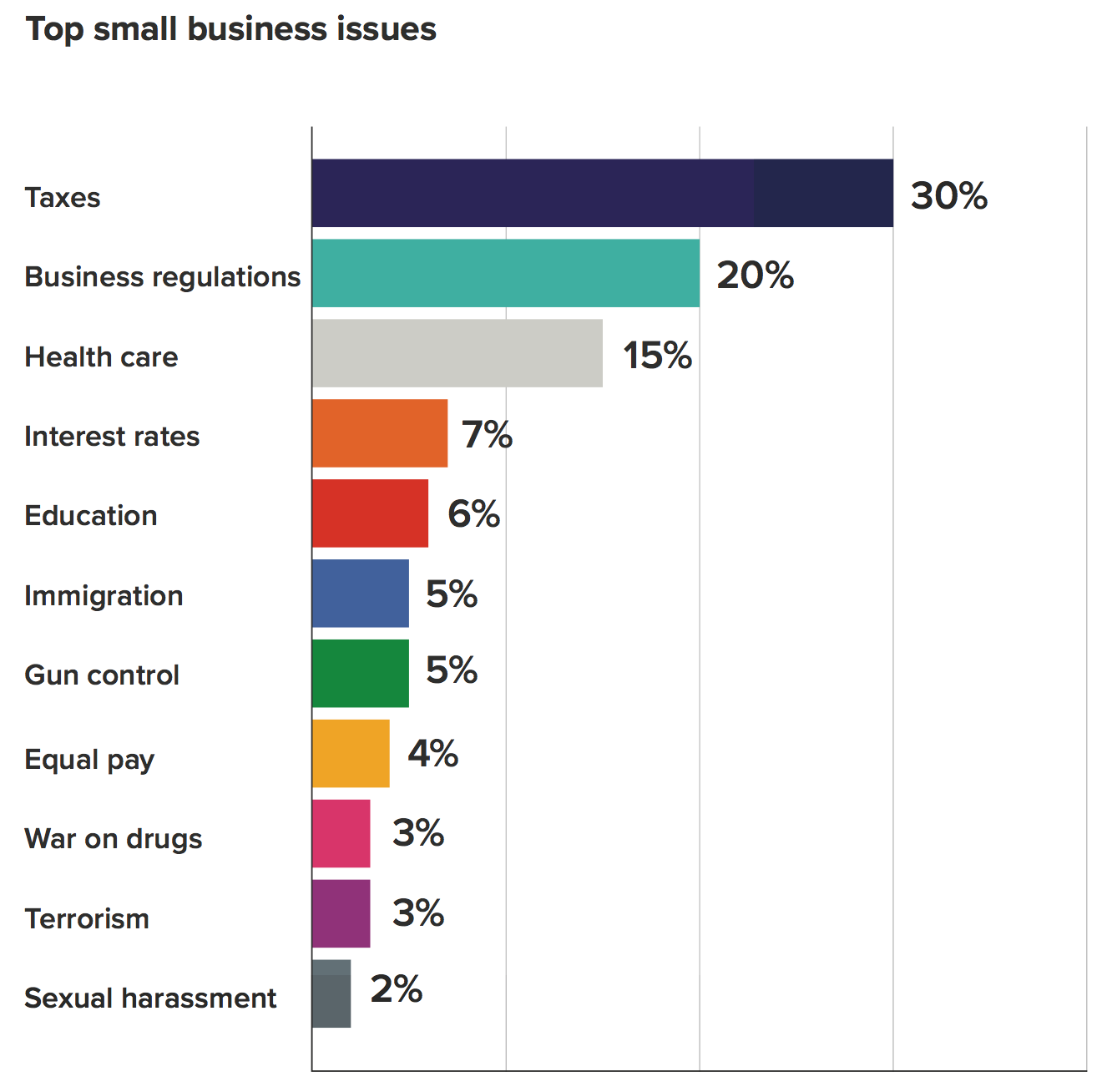

Hierarchy of needs

We asked business owners to rank the political and policy issues that are most important to them. The list below reflects the ratio of respondents that ranked each issue No. 1. The resounding message is that taxes, regulations, and health care are top of mind for small business owners.

Taxes

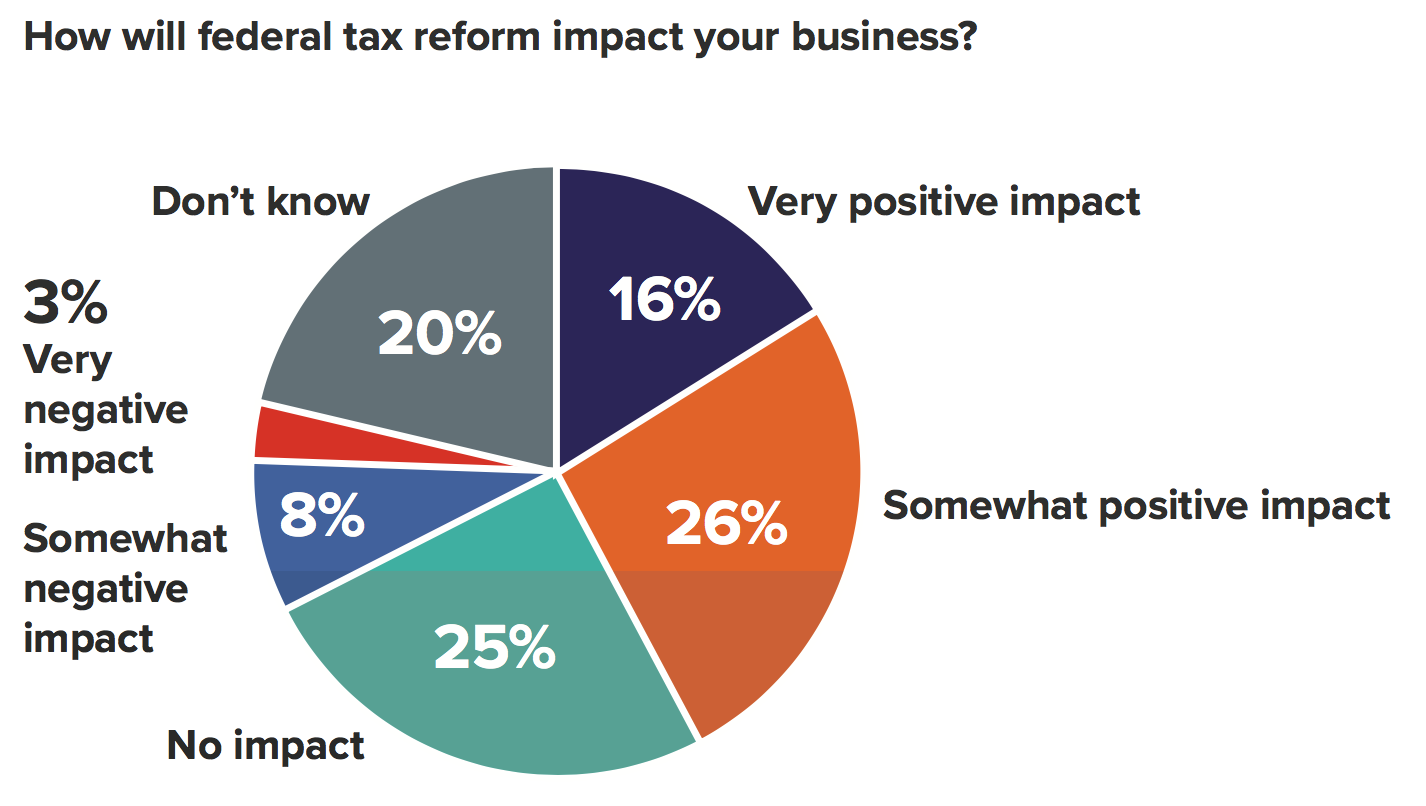

Taxes consistently rank as the top policy issue small businesses want changed in our surveys, and last year respondents told us they wanted tax reform above all else. Since the federal government passed tax reform this year, we asked respondents what impact they think it will have on their businesses.

About 2 in 5 business owners expect a positive impact, but notably 1 in 4 think it won’t change anything and 1 in 5 don’t know what to make of it. In short, the new tax law is getting mixed reviews in early returns from small business owners.

Business regulations

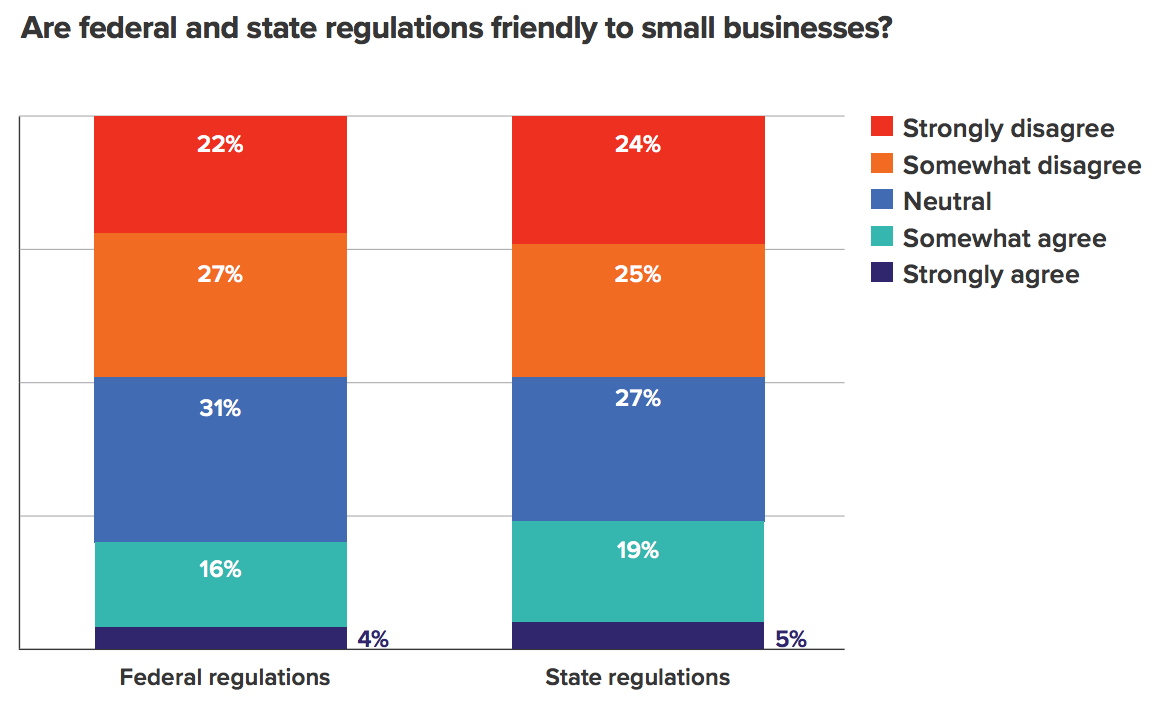

Regulations are always a hot topic for small business owners. We asked respondents what they think about the federal and state regulatory environments. Here’s what we found.

In general, small business owners don’t feel like federal or state regulations are friendly to companies like theirs, although they view state regulations slightly more favorably than federal ones.

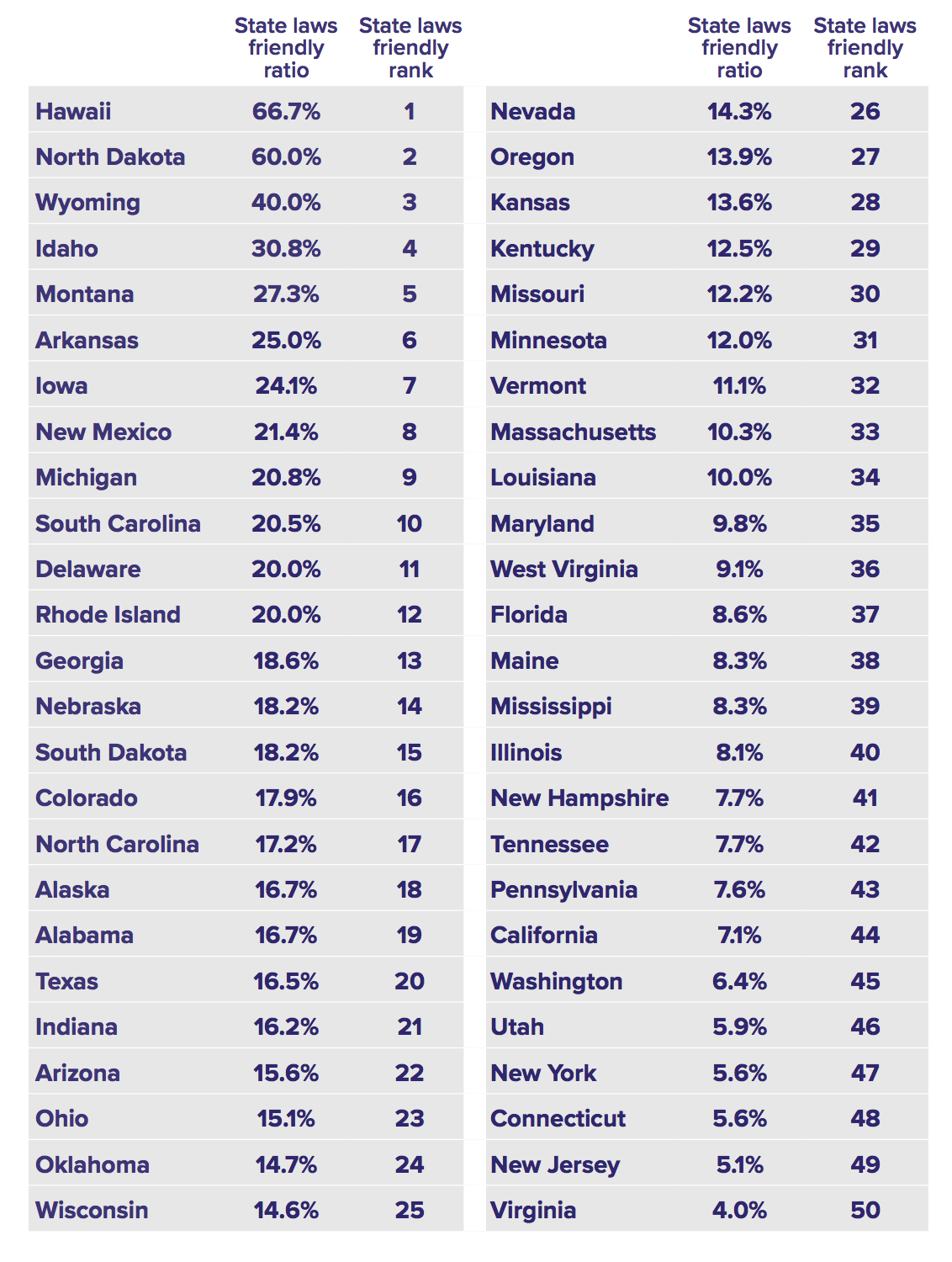

Next, we ranked all 50 states and the District of Columbia based on how friendly their regulatory environments are perceived to be by their local business owners. The list below shows the ratio of respondents who say their state’s regulations are friendly to small businesses.

Health care

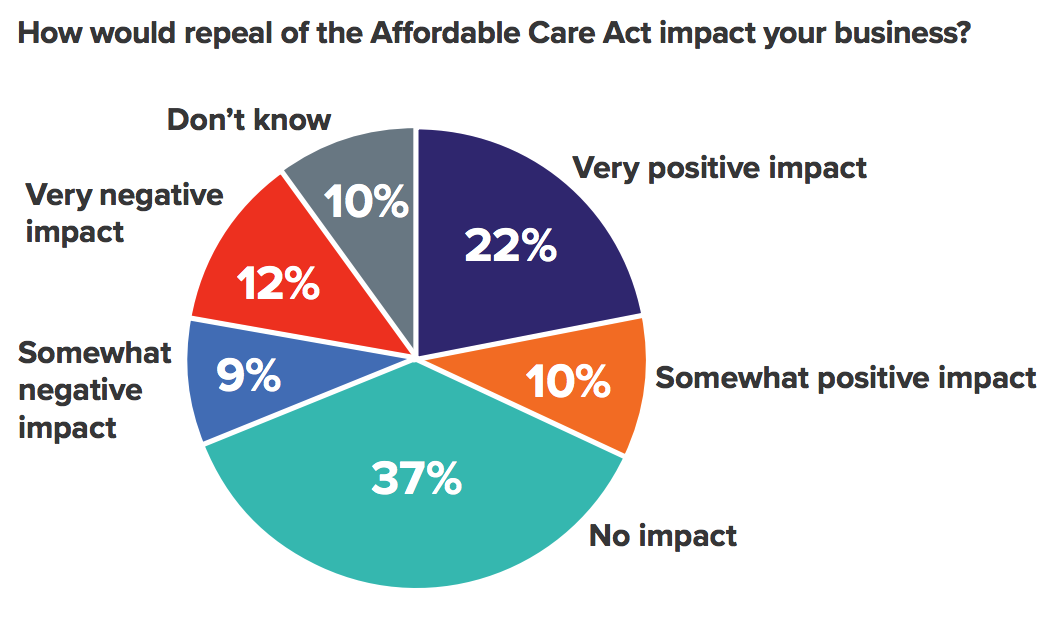

Last year, nearly 1 in 3 small business owners told us that repeal of the Affordable Care Act would have “no impact” on their business. That same pattern held true when we repeated this question in this year’s survey.

While health care is an important issue for small business owners, repeal of the national healthcare law tends to be more of a partisan issue than a pragmatic one, even for small businesses. Here’s what we found when we filtered this question by voting preference:

- 50% of Trump voters say Obamacare repeal would have a positive impact on their business compared to 7% of Clinton voters

- Conversely, 52% of Clinton voters say repeal would have a negative impact on their business compared to 6% of Trump voters

- Trump voters are 9x more likely to say repeal would have a “very positive impact” and Clinton voters are 9x more likely to say it would have a “very negative impact”

Interest rates

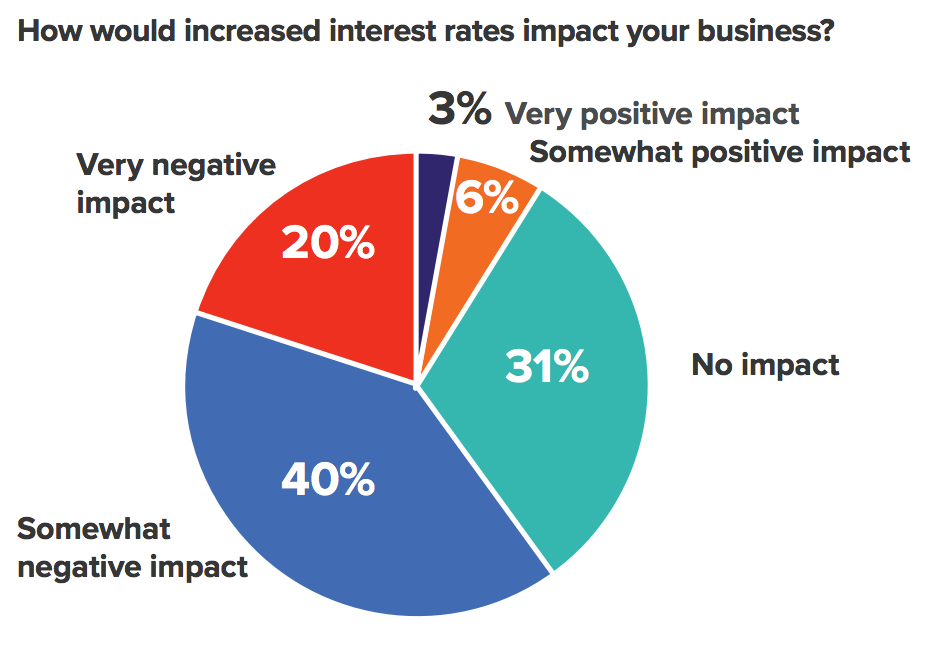

After years of low rates and cheap money, the Federal Reserve has indicated that interest rates may be on the rise over the next few years.

Only 22% of respondents say they plan to pursue new business financing this year, but interest rates impact small businesses in various ways. All told, 3 in 5 respondents say rising rates would hurt their companies.

METHODOLOGY: Womply polled 4,743 small business owners in all 50 states via online survey in April 2018.