Let’s say you run a small cafe, an auto shop, a medical office, a hotel or even a hair salon. Which threats would keep you up at night? If you’re like most, you’d be worried about a break-in, kitchen fire, flooding from a broken water line or anything else that would cause physical damage and put your shop out of commission for a while.

It’s easy to understand why thoughts of break-ins and physical damage keep business owners up at night. As they already operate on thin margins, the thought of an expensive insurance claim would be a living nightmare and could do some serious damage.

Perception isn’t always reality, and we often worry too much about the wrong things and not enough about the right ones. Truth is, the most pressing threats to small business revenue are online these days. Let’s walk through exactly why that’s the case.

Cash is King

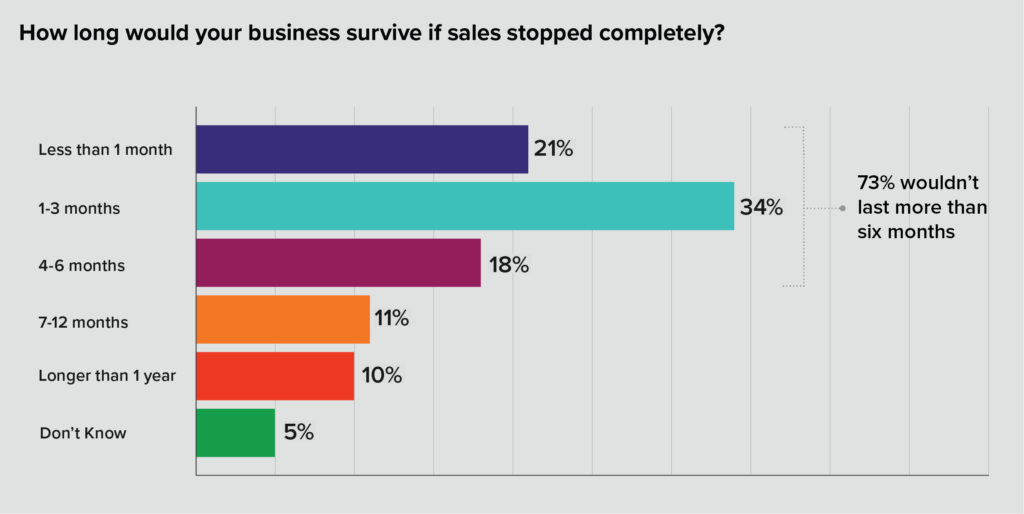

We surveyed 2,300 small business owners in all 50 states to see how they think about business threats. One startling finding: 1 in 5 small businesses would shut down within 30 days if sales stopped completely, and 3 in 4 wouldn’t last six months.

What’s most startling about these findings is how quickly sales affect the solvency of a business. This only confirms how thin small business margins are. Within three months, more than half of small businesses across America would close up shop if revenue dried up.

Top revenue threats

Knowing how vital cash flow is to a small business, we wanted to know which risks threaten revenues the most. If cash flow is king, what are his biggest threats? Physical damage to the store? A cyber attack? A hurricane?

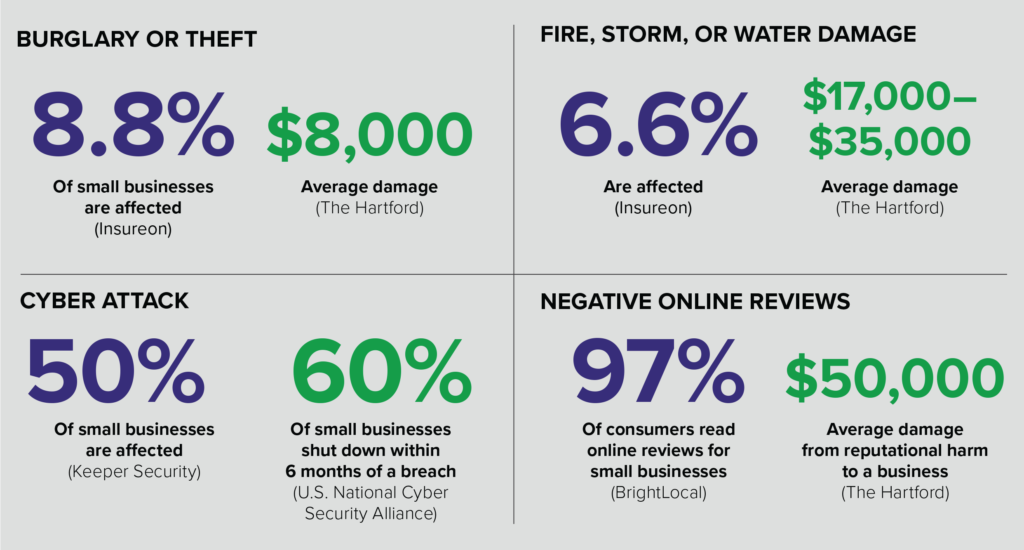

The truth about physical incidents: they’re not your biggest threat. While burglaries do happen, they’re actually quite rare and easier than ever to prevent. In fact, less than 9% of businesses experience a robbery or damage to the physical store.

Importantly, online reviews have emerged as a major threat to revenue if business owners ignore them. Consumers use forums like Yelp and Google My Business to decide where to spend money locally, and they’re much less likely to patronize businesses with low review scores or unaddressed negative reviews. The good news is you can take control of online reviews and actually attract more customers to your business.

Insurance Gap

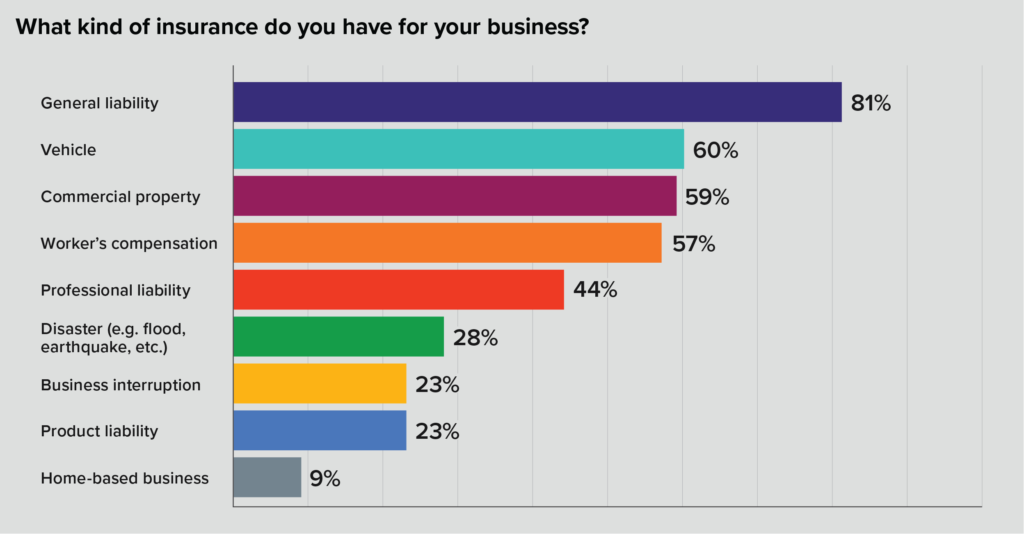

In our survey, we asked how small business owners insure their companies against threats. While most (81%) have general liability insurance, only 23% have business interruption insurance. This leaves small businesses highly vulnerable in the event of a revenue stoppage. (Disclaimer: Womply doesn’t sell insurance or have any vested interest in the insurance industry.)

Business interruption insurance is the kind of protection businesses need when revenue stops. A cyber attack is the kind of digital event that could bring a business’s ability to generate sales to a complete halt. Unfortunately, although 50% of small businesses experience some level of a cyber attack, only 23% of them have taken steps to protect their revenue with business interruption insurance.

Making sense of it all

Small businesses need constant sales to stay afloat, so business interruption is a big concern. Surprisingly, online threats are more common and pose a bigger threat to revenue than physical threats for small businesses.

You can protect your revenue by:

- Taking control of your online business reputation on sites like Yelp, Google, Facebook, and TripAdvisor.

- Installing antivirus software on any computer you use to run your business and teach staff to avoid phishing scams.

- Obtaining proper insurance for your business based on your location and sensitivity to business interruption and revenue stoppage.

- Leveraging tools like Womply’s reputation management solutions to manage and receive alerts to negative reviews and any threats to your online reputation. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!