Roses are red.

Violets are blue.

Is your restaurant thinking

about Valentine’s, too?

Pop quiz: What day of the year is the busiest day for restaurants? What day of the year is the most profitable for restaurants? If you guess Valentine’s (like we did), you’re way off.

Our data science team analyzed transactions at 26,000 small, independent restaurants across all 50 states across all 365 days of the 2017 calendar year. That analysis gave us a comprehensive look at when restaurants make the most money, when their tables are maxed out, and how prominent days like Valentine’s Day rank in the grand scheme of things.

As everyone gears up for Valentine’s Day this week, we thought we’d take a look at how the day will likely shape up for local restaurants across America.

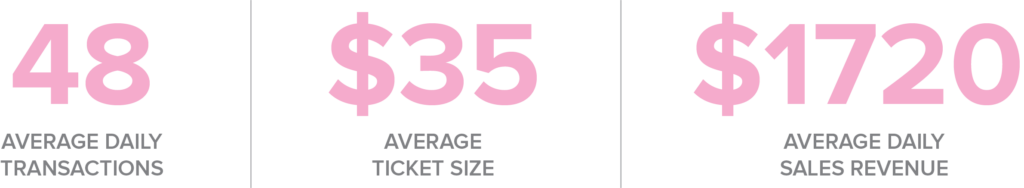

The average day for restaurants in 2017:

On an average day in 2017, the average independent restaurant saw about 48 transactions at an average ticket of $35. It all adds up to restaurants making about $1,700 per day and $45,000 per month.

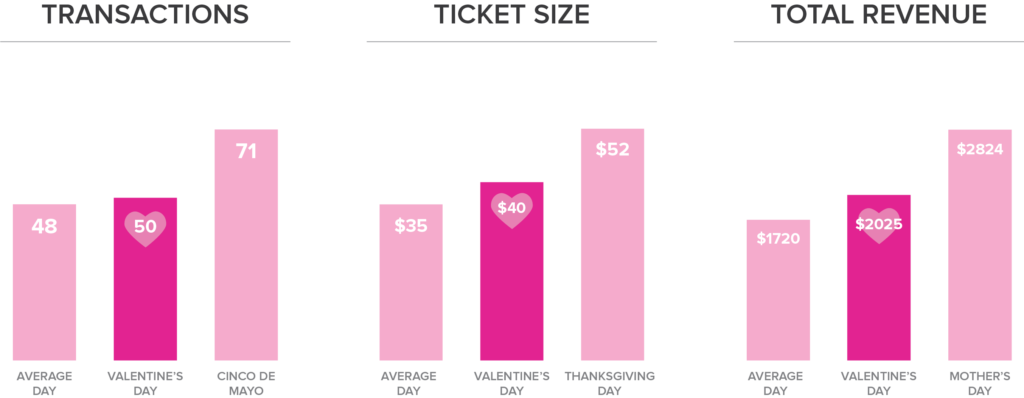

We used this information to establish the baseline of an “average day” at a small American restaurant. We then ranked every day of the year against that benchmark to see how transactions, ticket prices, and daily sales revenue compared.

One timely finding: Valentine’s day is a decent sales day, but it doesn’t even crack the top 100 days of the year.

The 107th best day for restaurants

Valentine’s may be all chocolates, flowers, and stuffed animals for lovers, but cupid’s bow is missing the mark for restaurants. Looking at three of the key areas of restaurant success, Valentine’s day is only slightly better than your average day. When ranking each day of the year from 1 to 365, it comes in at the 107th best day for restaurants.

When it comes to transactions, restaurants only saw a 4% increase on Valentine’s Day last year. That’s just two more transactions than the average day. The winner of most transactions in a day is Cinco de Mayo with 71 transactions or 48% more than the average day.

When it comes to ticket size, Valentine’s Day diners aren’t breaking their banks. They did spend 14% more per meal, but that only translates to about $5 more per order. Thanksgiving, on the other hand, has people going all-out, spending 49% more per ticket, although Turkey Day is one of the slowest days of the year for transactions and total sales.

When it comes to daily revenue, Valentine’s still isn’t that much better than an average day. The haul for restaurants on an average day is about $1,720. On Valentine’s Day, restaurants see a subtle 17% bump. Compared to Mother’s Day, however, that’s a hiccup. Restaurants across the board see about 64% increase in daily sales revenue on Mother’s day, making it the most valuable day for local restaurants in America.

Little romance for restaurants on Valentine’s Day

There are, of course, some outliers, such as white-tablecloth locations, but generally speaking, Valentine’s Day is basically as important to sales as the average weekend for most small, independent restaurants. One possible reason, as one restauranteur told us, is that Cupid’s big day turns into “amateur night,” with many preferring to impress their significant other with a home-cooked meal. Regardless the cause, Valentine’s Day isn’t as hot as we thought for the average independent restaurant.