In this 9-minute read:

- Have you met the basic PPP forgiveness terms?

- When can you apply for PPP loan forgiveness and what form should you use?

- Walkthrough/instructions for filling out PPP loan forgiveness application Form 3508EZ

- Walkthrough/instructions for filling out PPP loan forgiveness application Form 3508

- What happens next?

Now that you’ve received and spent your PPP loan proceeds, you can apply for loan forgiveness so that you don’t ever have to pay those funds back. For businesses that have borrowed more than $150,000 in PPP funds, the forgiveness process gets a little more complex because you’ll have more calculations to fill out than those who took out smaller loans. And, to make it still more complex, there are multiple forms to choose from.

In this article we’ll walk you through each of the applicable forgiveness application forms, which one is right for your business, and how to fill them out.

If your lender uses an online or internal process for completing and submitting forgiveness applications, this guide will still be useful in preparing you for that process.

Womply has made email marketing truly automatic for busy small business owners and all types of independent contractors. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!

Have you met the basic PPP forgiveness terms?

Before you apply for the forgiveness application, you’ll want to make sure you are aware of exactly how your PPP funds were spent, and what your employee count and compensation levels were like before and after receiving the PPP loan. This will help you accurately fill out your application and know whether or not you are eligible for PPP loan forgiveness.

The eligibility requirements for PPP loan forgiveness (for both first and second draw loans) are as follows:

- You must have maintained your employee compensation levels (there are certain exceptions for employees who left or were fired for cause; just keep proper documentation),

- You’ve spent at least 60% of your funds on payroll costs, and

- Any funds outside of payroll costs were used on other eligible PPP expenses

When can you apply for PPP loan forgiveness and what application form should you use?

You can apply for PPP loan forgiveness after you’ve spent your PPP loan proceeds (generally at the end of your 8-24 week covered loan period). To apply, you’ll ask your lender for the forgiveness application form and submit everything that you need back into them to process with the SBA.

PLEASE NOTE: Different SBA lenders may have different processes and even forms for PPP forgiveness. Be sure to consult with your lender and follow their instructions.

As we’ve mentioned, there are two different PPP forgiveness application forms if your loan was over $150,000—Form 3508 and Form 3508EZ. (If your PPP loan was for less than $150K, check out our instruction guide for PPP loan forgiveness Form 3508S.)

Form 3508 is the first application form that SBA set up for PPP loan forgiveness, and Form 3508EZ was set up later for a simplified application process for businesses that meet specific requirements.

To fill out Form 3508EZ, you must meet one of the following requirements:

- You are self-employed and don’t have any employees

- You have employees but did not reduce your employee count, did not reduce employee hours, and did not reduce employee wages by more than 25%

- You have employees but did not reduce their wages by more than 25% and could not operate as normal due to decrease business operations as a result of COVID-19 health guidelines

If you do not meet the requirements for Form 3508EZ then you will need to fill out Form 3508 (see below for our walkthrough).

Instructions for filling out PPP loan forgiveness application Form 3508EZ

When you are ready to fill out your PPP loan forgiveness application, download Form 3508EZ or get it from your lender and follow these instructions. (Remember, your SBA lender may have different internal processes or forms; be sure to talk to your lender and follow their instructions.)

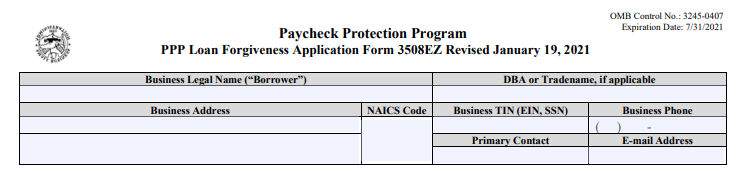

Step 1: Basic business information

The first part of the application should look very familiar since you entered in this same information on your PPP loan application. Make sure that this information matches the information from your loan application.

This information is as follows:

- Business Legal Name (“Borrower”)—if you don’t have a business name and used your own name for your loan application, then use that again here

- DBA or Tradename, if applicable

- Business Address (enter your street address on the first line and your city, state, zip on the second line)

- NAICS Code (you can find this here)

- Business TIN (EIN, SSN)

- Business Phone

- Primary Contact

- Email Address

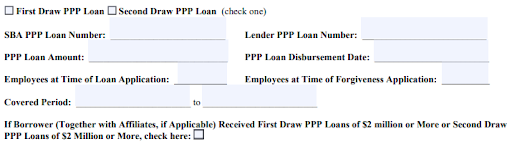

Step 2: Basic PPP loan information

Next, you’ll fill out the basic information for your PPP loan. This includes:

- Checking if this is for a first or second draw PPP loan

- Entering your SBA PPP Loan Number

- Entering your Lender PPP Loan Number

- Entering the PPP Loan Amount

- Entering your PPP Loan Disbursement Date

- Entering the number of Employees at Time of Loan Application

- Entering the number of Employees at Time of Forgiveness Application

- Entering your Covered Period

- Check if your business and its affiliates (if applicable) received a first or second draw loan of more than $2 million

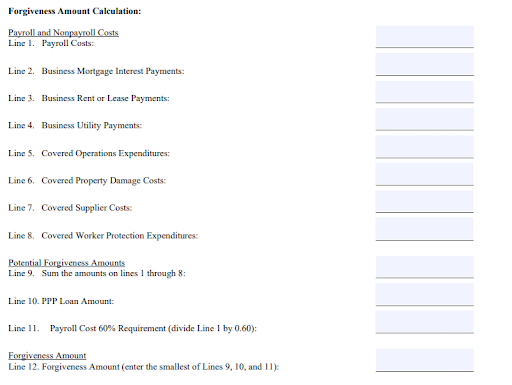

Step 3: Forgiveness amount calculation

Next, you’ll need to enter line by line your expenditures for your PPP loan. This includes how much of your PPP loan went towards the following expenses over the length of your covered period:

- Payroll Costs

- Business Mortgage Interest Payments

- Business Rent or Lease Payments

- Business Utility Payments

- Covered Operations Expenditures

- Covered Property Damage Costs

- Covered Supplier Costs

- Covered Worker Protection Expenditures

Once you’ve entered each of those costs into the application form, you’ll sum up those amounts on Line 9, enter your PPP loan amount on Line 10, and on Line 11 divide Line 1 by 0.60 to check your payroll cost requirement.

On Line 12, you should enter the smallest number from Lines 9,10, and 11 to see your forgiveness amount.

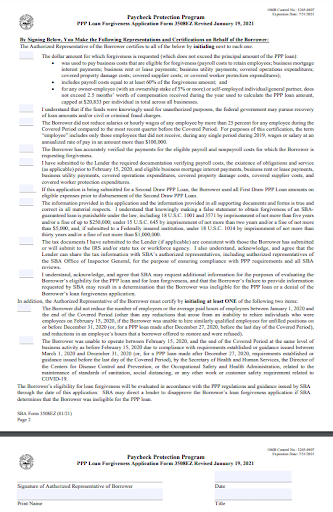

Step 4: Initialing and signing

Next, you’ll have 11 places (as indicated on the application form) where you’ll need to initial. Each of these statements is to make sure that you are eligible for forgiveness, have followed the rules, and have truthfully and correctly filled out your forgiveness application.

And then you’ll sign and print your name and date the application.

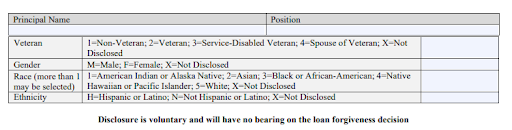

Step 5: Enter demographic information (optional)

On Page 4 of the application, you have the optional step of entering in your demographic information. This helps the SBA to gain a better understanding of how the PPP loans were used across the various demographics of America’s small businesses.

If you choose to fill this out, you’ll just enter your name and position, your veteran status, gender, race, and ethnicity.

Step 6: Gather documentation and turn into your lender

Once you’ve finished filling out your application, gather all of the documentation that you need to verify your expenditures (this might include bank statements, payroll documents, invoices, cancelled checks, lease agreements, etc.) and turn that all into your lender. If you’re not sure what documentation you need to include, ask your lender about it.

Skip past the Form 3508 directions and see what happens next.

Instructions for filling out PPP loan forgiveness application Form 3508

The instructions for this form are very similar to Form 3508EZ, except this one has some additional information that is required. To fill out this application, download it here or get it from your lender and follow the steps below.

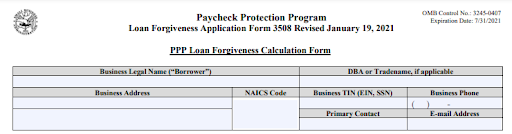

Step 1: Basic business information

The first part of the application includes your business information. This should be the same information that you filled out on your PPP loan application:

- Business Legal Name (“Borrower”)

- DBA or Tradename, if applicable

- Business Address (enter your street address on the first line and your city, state, zip on the second line)

- NAICS code (find this here)

- Business TIN (EIN, SSN)

- Business Phone

- Primary Contact

- Email Address

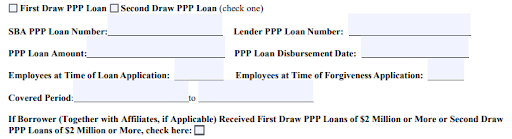

Step 2: Basic PPP loan information

Next, you’ll enter some basic information about your PPP loan, including:

- If this is for a first or second draw PPP loan

- SBA PPP Loan Number

- Lender PPP Loan Number

- PPP Loan Amount

- PPP Loan Disbursement Date

- Employees at Time of Loan Application

- Employees at Time of Forgiveness Application

- Covered Period

- Check if your business and its affiliates received more than $2 million for your first or second draw PPP loan

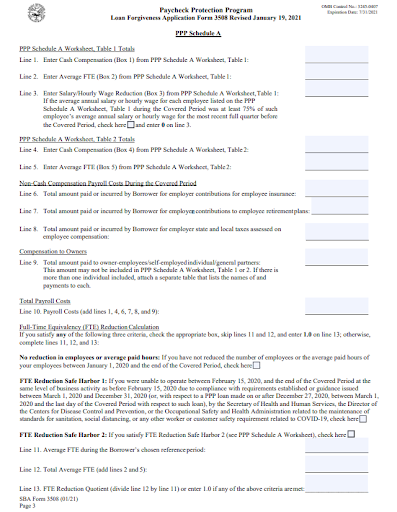

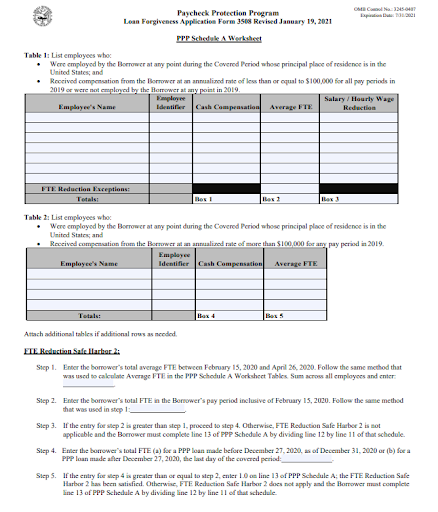

Step 3: PPP Schedule A

Go to page 3 and 4 of Form 3508 and fill out PPP Schedule A. This section of the application has a worksheet to help you calculate your payroll costs and full-time equivalency (FTE) reduction. You’ll need this information to fill out the rest of the application form.

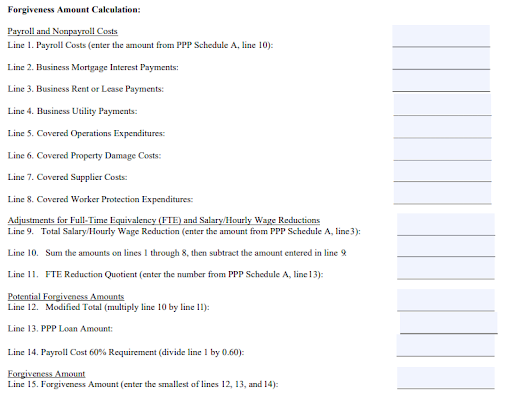

Step 4: Forgiveness amount calculation

The next part of the form allows you to enter in all of your expenses and helps you calculate how much of the loan you can receive forgiveness for.

First, you’ll enter your payroll and nonpayroll costs:

- Payroll Costs (enter the amount for PPP Schedule A, line 10)

- Business Mortgage Interest Payments

- Business Rent or Lease Payments

- Business Utility Payments

- Covered Operations Expenditures

- Covered Property Damage Costs

- Covered Supplier Costs

- Covered Worker Protection Expenditures

Once you’ve entered in your PPP loan expenditures, you’ll enter in adjustments for your employee counts and wages:

- Line 9: Enter the Total Salary/Hourly Wage Reduction (this should be the amount for PPP Schedule A, line 3)

- Line 10: Sum of the amounts on Lines 1-8, and then subtract the amount from Line 9

- Line 11: Enter your FTE Reduction Quotient (this is the number from PPP Schedule A, line 13)

Next, you’ll enter in your potential forgiveness amounts:

- Line 12: Multiple Line 10 by Line 11 to get your “Modified Total”

- Line 13: Enter your PPP Loan Amount

- Line 14: Enter your payroll cost requirement (Line 1 divided by 0.60)

And then on Line 15 you’ll enter the smallest number from Lines 12, 13, and 14 to get your forgiveness amount.

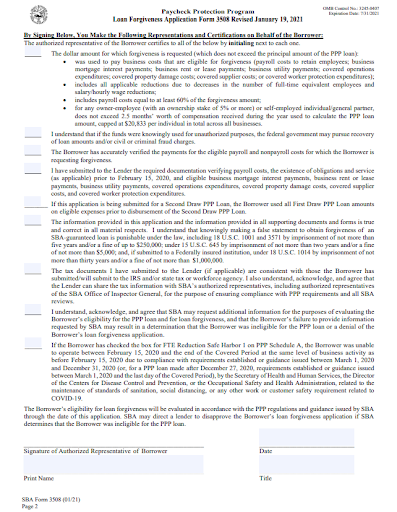

Step 5: Initialing and signing

On Page 2 of the PPP forgiveness application, you’ll need to initial in the indicated places to certify that you’ve met the specific requirements for PPP loan forgiveness.

At the bottom of the page, print and sign the form and include the date.

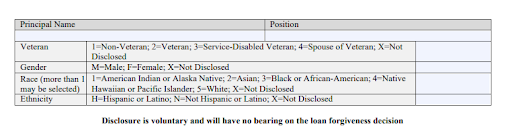

Step 6: Demographic information (optional)

On Page 5 of the application, you have the option to enter in your demographic information. This is completely voluntary and not a requirement to get your forgiveness approved. Should you choose to fill out this information, you’ll just need to enter your name and position, veteran status, gender, race, and ethnicity.

Step 7: Gather any additional documentation and turn it all into your lender

Once you’ve finished filling out your application, make sure that you have any documentation that you will need to send in to help verify your expenditures. If you’re unsure of what you’ll need, ask your lender.

Turn all of that into your lender with the application and they will process it with the SBA.

What happens next?

Once your lender has sent your application into the SBA, the SBA has up to 90 days to make a final decision. During this time, stay in contact with your lender. They will notify you with any status changes of your application and will let you know as soon as a decision has been made.

After you’ve submitted your application, you might find these additional resources helpful

- Do PPP loans affect business taxes and deductions?

- What happens if my PPP loan isn’t forgiven? Repayment and next steps

Win new customers, build loyalty with your existing customers, and strengthen your online presence with Womply!

Womply has made Email Marketing truly automatic for busy small business owners, independent contractors, and sole proprietors. Womply helps you turn customers into regulars and get more repeat business with targeted emails that send automatically when customers transact with you. Build customer loyalty and revenue, and get more repeat business with just a few clicks!

Womply Reputation Management makes it easy to keep up to speed with your online reviews on multiple sites at once. Our dashboard allows you to read and respond to all your reviews on all the popular platforms, all in one place with one login. Plus, you can set up automatic replies if you so choose, to help build customer engagement and loyalty, and improve your local SEO.

And don’t forget about Womply’s exclusive Customer Directory that gives you a preloaded list of all of your customers — including spend history, name, and contact information — that automatically updates with every transaction. This allows you to get smarter about your customers and their impact on your business to target the right ones, every time.

Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!