This week, the U.S. GDP report revealed a stunning figure. Q2 GDP shrunk by a record 33% as the coronavirus hammered the American economy. While GDP gives a window into a massive and complex economic landscape, it’s clear that small and local businesses have been hit especially hard.

“Local business GDP,” if such a figure existed, was almost certain to see an even larger drop than the GDP as a whole.

With Womply Email Marketing, you can turn customers into regulars and get more repeat business with targeted emails that send automatically when customers transact with you. Learn more when you sign up for Womply Free!

So we dove into our data to build our own “local business GDP” report to learn whether local businesses saw an even larger drop in Q2 spending than the broader American economy. To do so, we examined credit card transaction data from a sample of 330,000 small and local businesses from Q1 2019 through the end of Q2 2020.

Here’s what we found.

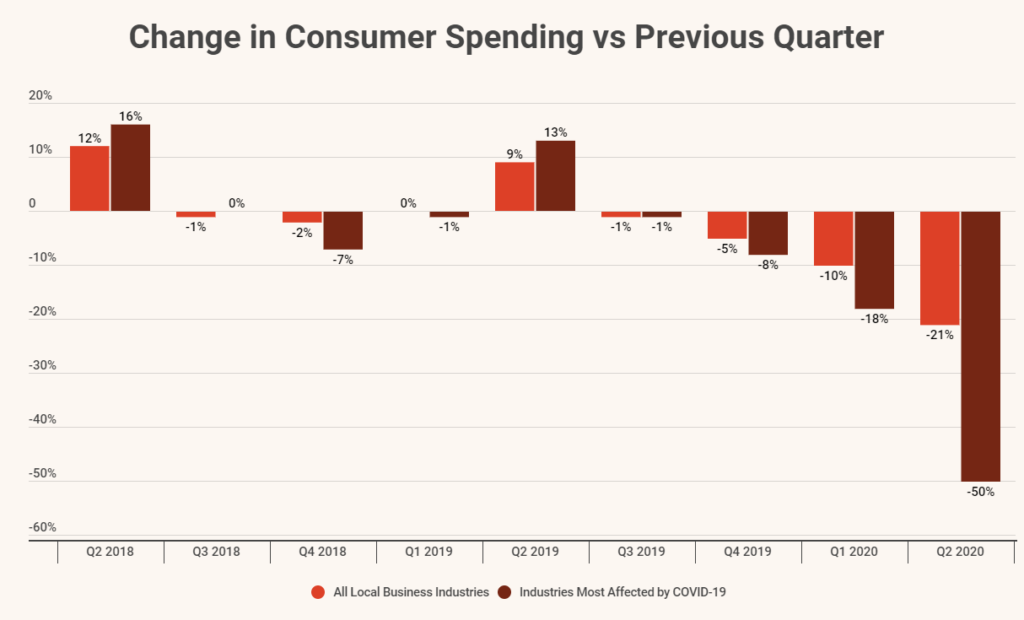

Q2 spending was down 21% vs Q1 at all local business industries, but 50% in industries hit hardest by the pandemic

Unlike GDP, local businesses expect to see slight increases and decreases from one quarter to the next. Seasonal trends bring heavy foot traffic in the spring and summer to get them through slower winter months, for example.

But what local businesses in our analysis experienced in the second quarter of 2020 was clearly a devastating drop during a typically busy time of year.

As you can see, all local and small businesses in our analysis experienced a 21% decrease in total consumer spending from Q1 2020 to Q2 2020. A stunning drop, no question. But when we isolated industries more likely to be negatively impacted by the pandemic, the figures get even grimmer.

Q2 2020 saw consumer spending fall by half at a combined view of the following industries: Restaurants, bars and lounges, health and beauty businesses, arts and entertainment businesses, parking businesses, sports and recreation places, and transportation businesses.

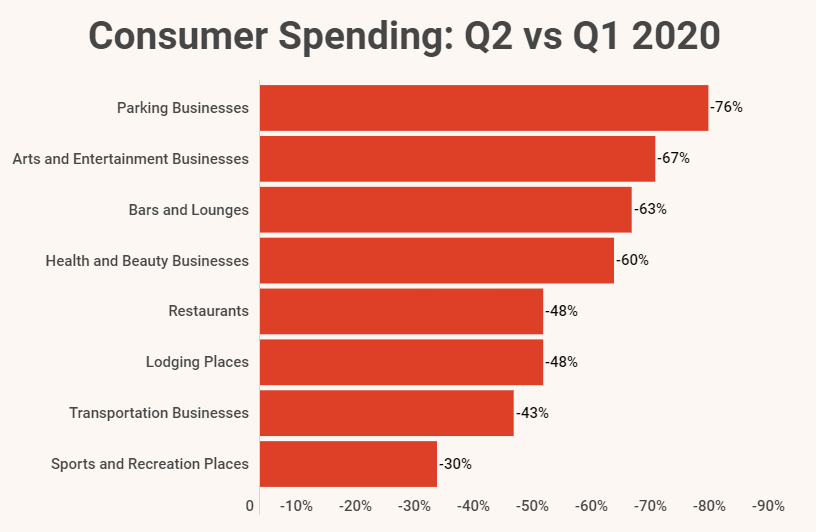

Here’s a look at how much spending dropped from Q1 to Q2 at each of the hardest hit local business industries in our analysis:

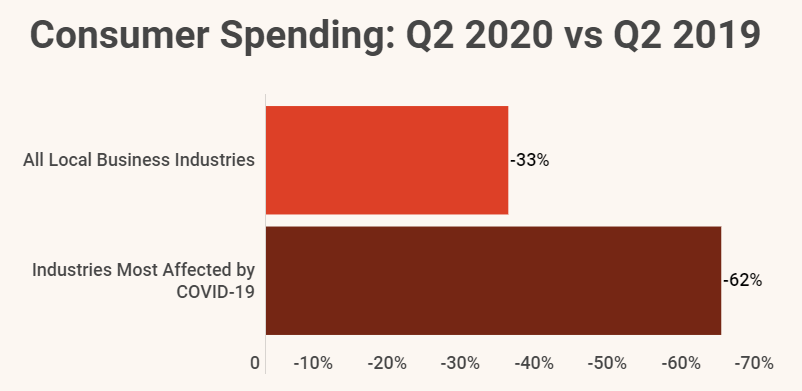

Spending at hardest hit industries was down 62% in Q2 2020 vs Q2 2019

Q2 is typically one of the, if not the single-biggest quarter of the year for many local businesses. Events like Spring Break, Mother’s Day and Father’s Day weekends, and the return of warm weather bring big days and boosted sales.

So comparing Q2 2020 to Q2 2019 reveals just how devastating the coronavirus pandemic has been to local businesses across the country.

The local business economy saw a 33% drop in spending between Q2 2019 and Q2 2020, but the most heavily hit industries saw spending plunge 62% from 2019 to 2020.

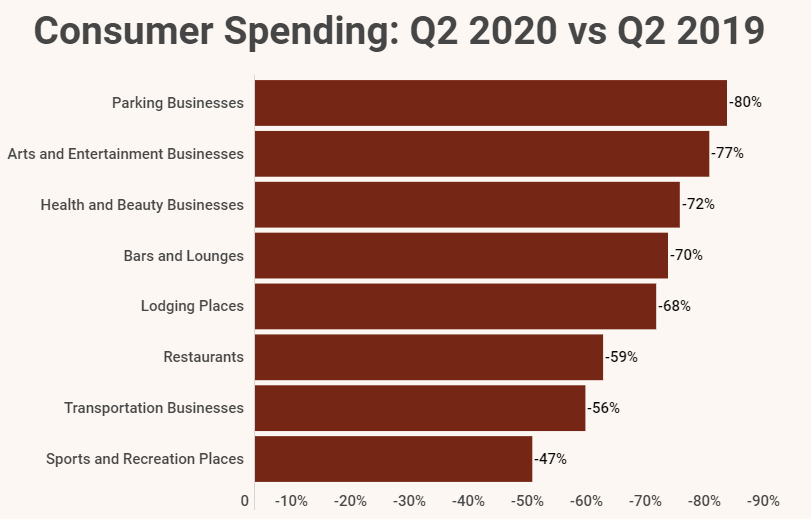

Here’s a look at how much spending fell at each individual industry from our combined view of those hit hardest by the pandemic:

View additional reports on the impact of COVID-19 on local businesses

The coronavirus pandemic has upended the lives of millions of Americans and devastated local businesses across the country. Check out some of our other detailed reports to see exactly how much local businesses have been impacted, and stay tuned for more updates and reports in the future.