The coronavirus outbreak has completely altered the daily lives of people across the United States. As state and local officials struggle to contain the spread of the virus, local businesses have had to reshape the way they do business. As a result, local businesses have already experienced huge drops in revenue.

Unfortunately, as some of our previous studies have shown, 55% of small and local business owners say their business wouldn’t survive if sales stop for 1-3 months. 21% said their business wouldn’t even survive 1 month.

As more cities and states continue to enact measures to slow the spread of the virus, we fear a growing number of businesses may be forced to close their doors.

The Womply Research team ran an in-depth analysis to learn just how many local businesses have already had to close due to the spread of COVID-19.

How many local businesses in different categories have stopped transacting entirely?

Here’s what we did in order to learn how many local businesses have closed due to the coronavirus:

- We analyzed credit card transaction data at businesses who were regularly transacting between January 1, 2020, and March 1, 2020

- A business was designated as “closed” if it didn’t process a single transaction for three straight days starting on March 1

- If, after that three day period, the business processed a transaction, they are no longer considered closed and we back-update previous dates to represent that business as being “open”

- An important note: Restaurants and other businesses who have shifted to processing 100% of their transactions via third party delivery apps (like Doordash, Grubhub, etc.) would also show as being “closed” by this metric

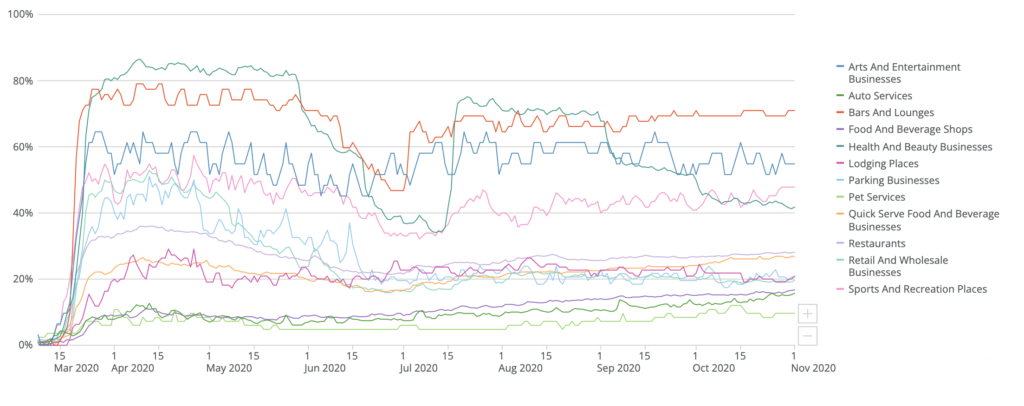

Taking the above requirements into account, here’s a look at how many local businesses in different categories have stopped processing transactions since the start of the coronavirus outbreak:

If viewing the chart below on a mobile device, rotate your screen for the best viewing experience

Again, it’s important to note that restaurants in our analysis are likely a combination of restaurants who have “closed” (stopped transacting entirely) and those who have switched 100% of their transactions to a third-party app like Doordash, Grubhub, etc.

Of course, some parts of the country were hit much harder and earlier by the virus, and some states have enacted long-term measures meant to contain the spread of the virus, while others have resisted such measures.

Let’s take a look at how many businesses have shut down in each state.

A closer look at some of the hardest-hit parts of the country

New York and California were home to two of the earliest major COVID-19 outbreaks. As a result, they were where we first saw officials enact some of the strict measures that have become common around the U.S.

Examining the timelines in those states and their major metro areas might give more insight into what may be in store for local businesses in other parts of the country.

How many businesses in New York have closed as a result of COVID-19

Let’s start by looking at the timeline for the entire state of New York, which has been under a statewide stay-at-home order since March 20th:

And here’s the timeline for the New York metropolitan area

Important dates impacting New York City businesses:

How many businesses in California have closed as a result of COVID-19

Let’s take a similar look at California, and then a closer look at the bay area and Los Angeles.

Now, a look at the bay area (specifically, the following counties: San Francisco, Alameda, Contra Costa, San Mateo, Santa Clara, and Marin):

As you can see, businesses in the areas hit hardest and earliest by COVID-19 saw a greater percentage of businesses close much earlier than the national trend.

Win new customers and build loyalty with your existing customers with Womply Email Marketing

Womply has made Email Marketing truly automatic for busy small business owners, independent contractors, and sole proprietors. Womply helps you turn customers into regulars and get more repeat business with targeted emails that send automatically when customers transact with you. Build customer loyalty and revenue, and get more repeat business with just a few clicks!

Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!